There is hardly anything tangible in this world that is more important than money. And while money may not be the most important thing in life, it most certainly is that key that enable us to enjoy the high standard of living and excellent quality of life we so desire and deserve. As the bible says in Ecclesiastes 10:19, “A feast is made for laughter, and wine maketh merry: but money answereth all things.” Our standard of living and quality of life will be determined by how much money we have.

“Beware of little expenses; a small leak will sink a great ship.” – Benjamin Franklin

Since money is so vital to our overall health and well-being, we must do everything in our power to accumulate as much as possible based on our maximum potential, and take the necessary steps to ensure our money is secure. So how do we manage and improve our finances?

Here are 8 Steps to Managing and Improving Your Finances:

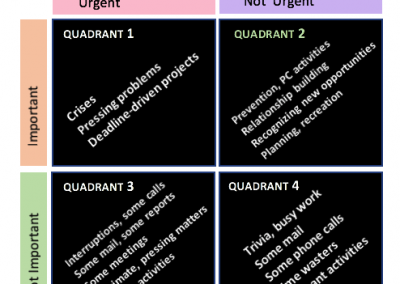

Step 1. Set Clear Financial Goals

One of the best ways that you can improve your finances is to set clearly-defined financial goals. You want to set short-term financial goals – within a one year period, and you want to set long-term financial goals – 2, 5, 10 years. Answer questions, like: Where would you like to be financially in the next year? Where would you like to be financially in the next 5 years? How will you meet your target? What will you do differently to ensure you accomplish each goal? Don’t just say you’ll make more money by the end of the year. How much more money will you have to make in order to achieve it? Set a figure. Map a plan. Do you want to get out of debt? Exactly how much debt do you plan on paying off, and exactly by when? Maybe your goal is to eliminate $5,000 of debt in the next year. Define that and set a date that you can move towards. Don’t make them some abstract target in your mind. Actualize them! Make them real! And the best way to do that is to write them out with real dollar amounts that have set dates by which to accomplish them.

Setting financial goals that are real and on paper creates a visceral transformation in your mind. When you can see your goals outlined there in front of you, you’ll do more to ensure you achieve them. The unconscious mind has a funny way of moving you towards what you ask it for, as long you make it real. When it’s abstract, it’s easier to get distracted and put it off. Make it real and measurable!

Step 2. Create Financial Milestones

Now that you have set your financial goals, it’s time to setup some financial milestones. They create a breathing space on our way to your financial goals. When you set a yearlong financial goal, the milestones are what make up the gaps between that year. For example, if you’re looking to pay off $5,000 of debt within 12 months, you could break that down into monthly or quarterly milestones – whichever work best for you. Financial milestones are important because they target the small picture as well as give you that added boost to actually see your efforts being paid off and be able to pat yourself on the back a bit and be encouraged to continue on.

Step 3. Create a Monthly Budget

A budget tells your money where to go, rather than have you wondering where it went. Creating a monthly budget is the best thing you can do for your finances (and your sanity)! It gives you a snapshot of your spending capacity, keeps you on track with your spending, helps you achieve a financial goal you set out to achieve, and provides some structure to your life. Budgets bring order to an otherwise financially chaotic life.

Today, creating a budget is easy. In fact, there are plenty of tools at our disposal – from smartphone apps to desktop-based solutions, you can find a budget friendly tool to help you get started with budgeting. And once you find your favorite tool, simply build yourself a budget that you can stick with, and stick with it. Of course, sticking to a monthly budget can be difficult, especially when certain habits are ingrained but if you know that you have some bad habits that are costing you dearly, prioritize the elimination of those habits. Keep in mind that if a goal means something profound enough to you, you’ll do whatever it takes to reach it, and that includes eliminating any and all financially-draining habits. Commit to doing it for 3 months and after 3 months it will begin to stick with you and subsequently become a habit – a good habit.

Step 4. Track and Monitor All Expenses

Tracking your expenses is one of the most important habit you can develop. In fact, you can put your financial life in jeopardy if you do not intentionally track and monitor your finances. Without proper tracking, you will lose sight of where you are financially, which makes it easier for you to overspend – having a false sense of security. When you can see your money in and outflow – right there in front of you, it’s harder to lose sight of how much you’re spending and on what you are spending. If you are a frivolous spendthrift, when you track your expenses you will be able to see the cost of your bad spending habit much easier, and be able to possibly make some future changes.

There are many free apps available to help you track your expenses, and it’s imperative you take advantage of one such as Mint.com.

Step 5. Prioritize Debt Repayments

One of the biggest deterrents to making headway in financial improvement, is the overwhelming debt that most people face. When you’re faced with enormous debt, it’s hard to concentrate on anything else. It deters you from looking at bank account statements and anything money related such as bills, and so the sooner that debt is repaid, the better you will feel. Also, paying down those debts will build momentum, and once you get in the habit of paying off debt, your overall spending will fall in line with it.

To prioritize your debt, pick the highest interest credit card that you have, and double the minimum payments until it’s paid off. Then, switch to the next highest interest credit card and continue until they’re all paid up. If your goal is to get out of debt, not only do you have to make a plan for repayment, but you also must monitor your spending habits.

Step 6. Open Bills Immediately & Pay On Time

Dodging bills and putting off opening them up could end up hurting your pocket. Yea, yea, we know you know, but seriously, bills can accumulate interest! Also, you may be given a break on the balances of some bills you owe with a specific time period; however, if you do not open them within that timeframe, you will not be able to take advantage of that opportunity.

Of course, the frequency of bills can sometimes put a damper on the spirit, but the downside of not staying on top of them is that you could end up making the next one bigger – with the interest and other fees that are added due to late payments which is defeating the purpose of not opening the bills in the first place – trying to avoid spending but end up spending more. If you are in a position to automate your bill payments, we highly recommend that you do. However, you must always check your money out processes, to ensure the monies going out of your accounts are all spending you authorize, as well as to keep abreast of your balances so you do not have dishonored checks or returned payment fees.

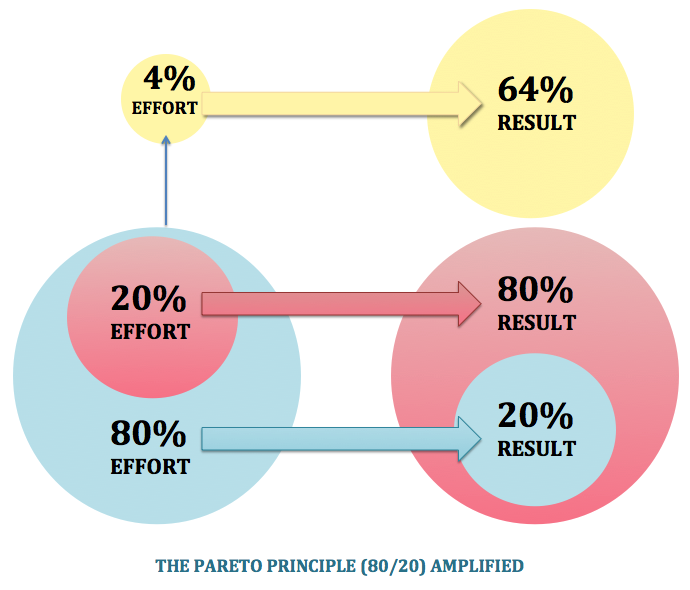

Step 7. Save & Invest at Least 20% of Your Income

Saving and investing should be the number one priority, especially for women, who usually place great value on security and stability. But, for many women, it’s not! Some has the money flow to really get on with some serious savings but refuse to do so, while others struggle to break even let alone save. However, as the old saying goes, “It’s not how much you earn but how much you save that makes you a woman”. So regardless of your earning right now, pay yourself first! That means take a portion (20%) and tuck it away in a high-yield savings account until there is enough to invest in a bigger way.

We know how difficult some women are having it trying to survive on a nickel and a dime. In fact, according to one study by BankRate.com, 76% of Americans are living paycheck to paycheck. That’s more than two-thirds of the population in the world’s richest country. The study also concluded that fewer than 1 in 4 Americans have enough in savings to last them 6 months should they lose their ability to earn income. But you cannot continue to make this your reality! You may want to take advantage of one of our signature money-making programs.

Step 8. Take a Daily Money Minute

Things happen! Accounts get hacked, bank make mistakes, and you could lose some money either way. So at the end of each day, take a daily money minute. Login to your bank accounts and review the transactions for that day. You want to ensure that you know what money is going out of your account and why. You also want to verify you are on budget for each of the categories you’ve set your budget up for. If you are over on any category, then you know you are through spending on that category for the remainder of the month. If you are tracking your expenses, you should be able to double check this with ease.

Reviewing your financial picture on a daily basis is all part of the money minute. Your money minute could be 5 minutes, 10 minutes, 30 minutes, or even an hour. This all depends on how committed you are to your saving, spending, and investment objectives.

Take these 8 above-mentioned steps and get on your journey to better money management and ultimately – true financial independence.

With love, gratitude, and empowered attitude,

, read it and implement the strategies in your life.