5 Steps to Getting Out of Debt and Staying Out of Debt

Having huge amounts of debt can wreak havoc on our emotions and even wreck our relationships. It can feel like eternal servitude being obligated to pay out large portions of our monthly income for pleasures we have already enjoyed, trapped as puppets in a very calculated zero-sum game of financial chess that leaves us as mere pawns on the playing field. Yes, having huge debt is serious business!

So how can we get out of debt and remain debt free? Let’s first take a look at why the majority of us get in debt in the first place.

Debt is, for the most part, accumulated by impulsive behavior. When we have those I-need-to-have-it-now moments in life that serve to balloon us out of our circumference of affordability, we often do not think about the consequences of our impulsive action, and are usually only keyed in to the pleasure we will be getting from whatever we are entering into debt for. So money in those instances to us is merely a tool in our virtually endless quest to constantly gain pleasure – at whatever cost. This uncontrollable behavior stems from deep down within our psychic apparatus – the Id, Ego, and Superego, which is the driver of the thing we call our minds. So the first thing we have to do to combat this persuasion from our psychic apparatus, is to learn to create some awareness to this interaction so as to override it.

What can be added to the happiness of a man who is in health, out of debt, and has a clear conscience? ~ Adam Smith

Here are 5 Steps for Getting Out of Debt & Staying Out of Debt

Step 1. – Analyze your Debt

The first step to getting out of debt is to make an analysis of your debt. You cannot get out of debt without first understanding how much and what kind of debt you have. We know many of you have a vague idea of what you owe and to whom; however, in order to know exactly what you are getting ready to tackle, and the options available to you, you must write down all your debt and the corresponding parties you owe. Facing debt is not an easy task! We here at MBB know how difficult it can be to face the music of your debt load, but we also know that it must be done if you are serious about ridding yourself of debt for good. Many of us weren’t always debt free! And the biggest problem most of us faced, was that we did not want to look at our debt situation. We did not want to face it! We would rather turn a blind eye, cause we’re too afraid to see just how much debt we’ve racked up. It’s frightening – we know! However, if you cannot analyze and understand your debt, then there is absolutely no way you can rid yourself of those debts and emerge debt free. An analysis must be done!

So, if you’ve not been keeping track of your debt, gather all your bills for the past 12 months and get to a table so you can start organizing and tallying the numbers. Organize your bills in date format, with the most recent on top. Now, you are ready to organize and tally your numbers. We recommend you use an accounting software such as QuickBooks, Mint, or FreshBooks to do this, or at the very least a Spreadsheet, because they make it so much easier to edit, make changes, calculate, and store in an organized way. If you do not have any of these, do not allow that to hinder your progress. Get a sheet of paper, turn it in a landscape position (or rectangular) and at the top of page, write a main heading “My Current Debt to Date – (input the date you are doing this)”. Next, create 4 columns below the main heading with 4 headings: 1) Creditor’s Name, 2) Amount Owing to Date, 3) Fixed Interest Rate 4) Average Variable Interest Rate. Use the last bill from each creditor to fill in each column and rows. Then tally the total of column 2 – Amount Owing to Date and write that figure down at bottom of column 2 below the last used row. Be sure to include and calculate all of your debts – from credit cards, to car loans, personal loans, student loans, mortgage, insurance, and everything else. Now that is what you owe to date, with the exception of the missing interest that may be accumulating on a daily basis. Each debt terms will most likely be different, likewise the interest rates – some may be fixed and some variable. Now you want to calculate the interest rate you’ve been paying per month for each variable interest debt. To do this, find the average interest by adding all the interest for each month of the creditor and dividing that total by the number of months. You want to tackle the highest-interest rate cards first, as well as the variable interest debt in order to wipe those out as quickly as possible.

Step 2. Create a Budget

A budget is telling your money where to go instead of wondering where it went. ~ Dave Ramsey

Now that you have analyzed your debt, it’s time to create a budget, or adjust the one you currently have. There is no way you’re going to pay off your debt without making some adjustment to your spending and sacrificing some things. So, in this new or newly adjusted budget you will leave those things in place that cannot be carved such as your rent/mortgage/insurance and any other fixed payments you have. Then decide on what you want to cut back on in terms of using less electric/water/gas/phone etc., and possibly spending less on cosmetics/clothing/entertainment/traveling. The one thing we recommend is that you do not cut back on the quality of foods you eat. If you usually eat out a lot, you may want to start preparing your own meals at home, but you must insist on enjoying the same quality of healthy foods so you do not compromise your health. The last thing you need as you go through this transitioning from debt trapped to debt free, is a medical bill. We here at MBB do not believe in lowering our standard of living; we believe in elevating our monetary strategies and increasing our finances to meet our standard of living instead. However, drastic times demand drastic measures, and working to get out of debt that can be so crippling, warrants this deviation.

Step 3. Bargain With Your Creditors

Call up your creditors, and seek out a bargain. Many creditors will be happy to make a deal with delinquent debtors. They will be happy to get back a portion of the monies owed to them and close out old debts, rather than lose the entire sum of money. Some creditors you just can’t bargain with, but most will welcome your call and attempt to resolve your debt situation, and be more than willing to cut your debt – astronomically.

Step 4. Set a DEBT FREE Goal

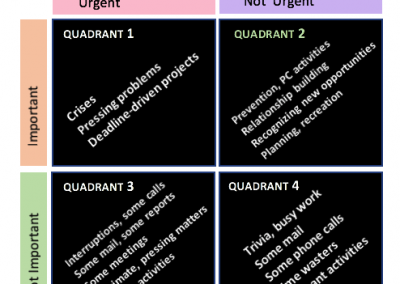

Now that you understand your debt and has bargained with your creditors, it’s time to set a debt-free goal, which means you cannot continue to keep up with the Joneses (and the Kardashians). Depending on how badly you want to get out of debt, your situation will now be different. The way you go about doing what you do in living your life, will have to change as getting out of debt takes precedence. If you are truly ready and committed to becoming debt free, then you will make the drastic changes necessary to achieve that goal. Be realistic and specific about your debt free goal. Don’t make it so drastic that you won’t have food – healthy foods, as you go through this process. If you know you are only able to put $1000 each month towards this goal, do not lay out a plan for $2000 or even $1500 per month. Put the $1000 down as what you will pay out. It may take a bit longer, but you will not feel too strapped and possibly jeopardize your health in the process. You want to come out debt free but still healthy and whole at the end of it all. Also, be specific about a deadline. Based on how much you owe and how much you can pay out each month, divide them to see how many months it will take. Keep that month as your goal deadline. Now, you may be able to pay out more some months than others, depending on your situation – if you have a side hustle or run a business – but even when you do that (and by all means do that), you want to keep the $1000 each month as your realistic amount on your paperwork. There is hardly any better feeling than completing your mission and achieving your goal way before the time you have set.

Step 5. Increase Your Income

There are so many ways to increase your income, and based on your individual situation – whether you’re working a 9-5 or running your own business – technology and the Internet make it possible and easier for anyone to uplevel their finances. If you are working a 9-5, consider using a part of your skillset to bring in money on the side. You can do this by creating a course to sell, which will bring you passive income as we so highly recommend, or you can write a book about a topic that you know a lot about that you know is in demand. You can also use any of these 7 Income streams that can truly uplevel your net worth. If you are a service business owner, you can choose to package and position your services, or an aspect of what you do in course format, so that you too can take advantage of some passive income. If you are product based, you may want to rethink your marketing strategies, and reposition your products so a wider market can access your products. If you are not using social media marketing, you may want to take a look at it, as it is one of the most effective marketing tool in today’s technologically advanced world. Increasing your income or money inflow should always be on your agenda. Money can never be too much!

BONUS TIP: Use a software to keep a record of your income and expenses. There are many free software on the market to date, such as Mint.com and Wave.com. This will give you a clear precise picture of where your money is coming from and most importantly, where it is going. This way you can analyze and cut back on your outflow – where necessary, and work at improving your money inflow. These software will allow you to see a complete snapshot of your monthly money flow, so you can quickly nip the unnecessary expenses in their bud, and work at increasing your income.

With love, gratitude, and empowered attitude,