Calculate my net worth? Yea, it’s a thing. It sounds like measuring yourself against money to see how you stock up, and that really suck connecting your worth to money, but in our society? That’s how it is! And as you may have already surmised, the higher your “net worth”, the better the standard of living you will enjoy – not quality of life! But standard of living. There is a difference!

That said, the only way to know your net worth, is to make the calculations. But before we get to that, let’s take a look at what makes up “net worth”.

Your net worth is your assets (things you own) minus your liabilities (things you owe). So things like your home counts as an asset, but if you have a mortgage for your home, your mortgage counts as a liability. Because your mortgage is a debt, it’s something you owe so that would be taken away against the price of your house – that you own. So for every liability there is usually a corresponding asset, and the net of the two is usually positive – meaning, the asset value is usually more than the liability.

Things like car loans, credit card debt and other financed options are all liabilities that can count towards the negative side of your net worth calculation. Things like house value, savings, investments or other money making assets can count towards the positive side of your net worth calculation. In other words, debts that help you add value to your bottom line or create wealth, are “good” debt, good liabilities – such as a mortgage for a rental property, or a truck you use to haul goods and get paid. And debt that take away from your bottom line are “bad” debt – such as credit cards you use to buy things you use up without any returns such as car for personal use, clothing, food, and any number of other things that will not return money to your pockets.

How To Calculate Your Net Worth

To calculate your net worth you need to first ascertain your assets. These are the things you currently own or could sell, in theory, to gain money back. These include:

Your house(s) or building(s)

Your house(s) or building(s)

Your car(s)

Your car(s)

Your total savings account(s) balance(s)

Your total savings account(s) balance(s)

Your total investment(s)

Your total investment(s)

Your total checking account(s) balance(s)

Your total checking account(s) balance(s)

Anything of significant value in your home (over $500)

Anything of significant value in your home (over $500)

If you add all of these numbers together, this is the total of your assets.

Next, you need to determine your liabilities. These are things you owe, and could include:

Your total mortgage(s) balance(s)

Your total mortgage(s) balance(s)

Your total car(s) loan(s) balance(s)

Your total car(s) loan(s) balance(s)

Your total credit card(s) balance(s)

Your total credit card(s) balance(s)

The total of any other loan(s) you have

The total of any other loan(s) you have

Add all these together, and this is the total of your liabilities.

Then, to identify your net worth, minus the total of your liabilities from the total of your assets. That number difference is your net worth.Depending on your individual circumstances, this might be a negative number, but don’t panic! This just means your finances need some work and this is your reference point from which to rise.

We suggest doing this at the end of each year to see the overall progress of your finances, but we also recommend that you track and manage your finances at least on a monthly basis. We do our comprehensive financial stance on the last day of each year, but we also track and manage our finances monthly – individually, and collectively. Whether you own a business or not, you need to track and manage your finances. A monthly tracking and monitoring of your finances gives you a complete picture of your financial stance, putting you in the know so you can do something about it – if it is not favorable. We all want our finances to be healthy – like we are, but if your number is in the negative, then you can work on improving and changing that – sooner than later. It’s also a great idea to do a daily money minute.

How to Improve Your Net Worth

The best way to improve your net worth is to uplevel your money inflow, minimize your money outflow, invest, and track and manage your finances. There are lots of ways to track your finances to see if you are on the right track, and where you need to make changes, and one of them is creating a budget and sticking to it. And thankfully, there are software – paid and free, that can help you track and manage your finances. Some of them we use, recommend, and are familiar with are: QuickBooks (paid), Quicken (paid), Mint.com (free), EveryDollar.com (free).

Creating a budget (and sticking to it), tracking expenses, and saving money are all ways to not only ensure you meet your money goals, but help you know where you are financially – at any given moment.

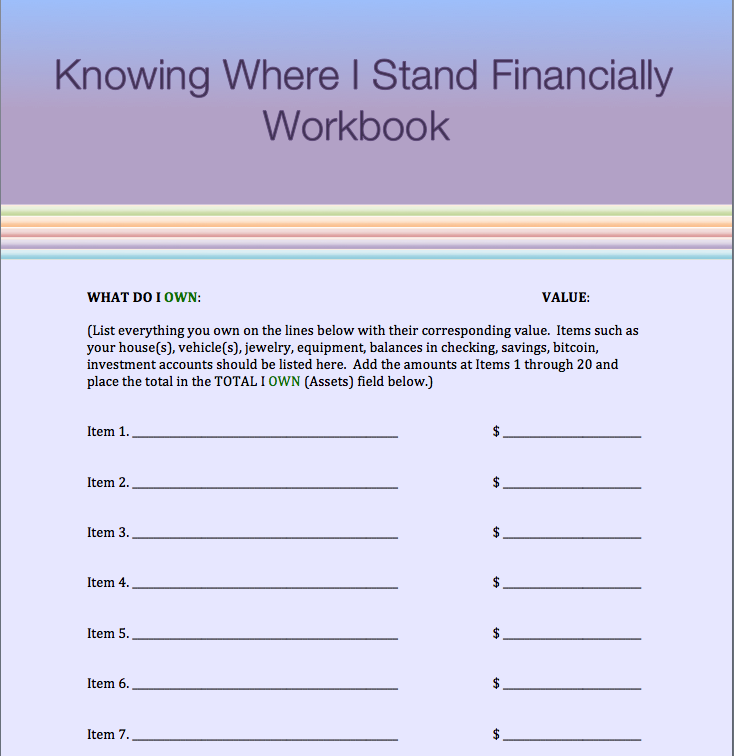

So, calculating your net worth is fairly simple, and whether it is in the negative or positive, there is always room for improvement. Never stop working at improving your finances, upleveling your net worth!Knowing Where I Stand Financially Workbook

Download your free copy of our net worth calculating worsheets – Knowing Where I Stand Financially Workbook

With love, gratitude, and empowered attitude,

The first time I heard that term I thought, “mmmm, what a weird term?” I was shopping for life insurance and that was one of the questions I was asked. It really triggered me. But I’ve since come to accept it, and move on to other things. I mean, what am I going to do? Snub it? Moreover, it has really helped to make a difference in my life. I not only look at net worth in terms of money, but also in terms of my health, my network, my support system, and my education and knowledge base. It is good to know how much money we have, but it is also good to know how effective our intangible net worth is as well.

I read a book I believe it was written by Tanisha Toney Burke – a travel planner – called Network to Increase Your Net Worth, and that’s where I got a wholistic approach to net worth. I believe it is important to approach net worth in a comprehensive way so we’re not only prepared monetarily but also with the proper health and support systems which is true wealth.

Very informative article! That daily money minute is no joke. It saved me a few hundreds a few times and I highly recommend it.

That’s one of the first things I learned:

“Things like car loans, credit card debt and other financed options are all liabilities that can count towards the negative side of your net worth calculation. Things like house value, savings, investments or other money making assets can count towards the positive side of your net worth calculation. In other words, debts that help you add value to your bottom line or create wealth, are “good” debt, good liabilities – such as a mortgage for a rental property, or a truck you use to haul goods and get paid. And debt that take away from your bottom line are “bad” debt – such as credit cards you use to buy things you use up without any returns such as car for personal use, clothing, food, and any number of other things that will not return money to your pockets.”

And I’ve been very mindful of my net worth ever since. So necessary 🙂

I learned about net worth in your MASTER Your Finances program. Of course it is centered around money, but I actually thought it was necessary as that is how it is represented in society. But to me, net worth is more than just the amount of money/asset we have. It’s the total net sum of tangibles as well as intangibles.

I’m sharing this post with my network because I know someone who could really use the workbook, and I’m sure there are others who will benefit as well.

Thanks for sharing.

Thanks for sharing this workbook. Not only am I using it but I’ve shared this link with my entire family, friends, and network. Appreciate the value you have here on this website. Bookmarked!